Indexation, tripartite and telework in supervised entities

1. New indexation on 1st April 2022

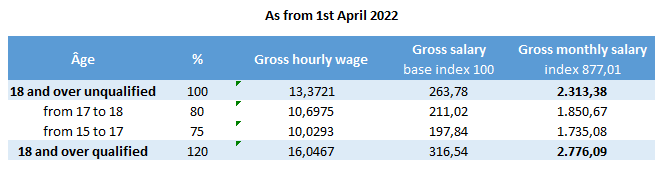

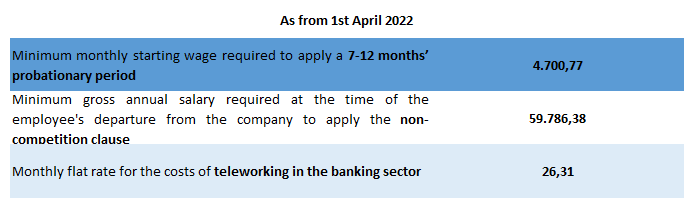

According to the STATEC release of 30 March 2022[1], the wage index increases from 855.62 points to 877.01 points as of 1st April 2022, resulting in an increase in the minimum social wage and the adjustment of certain thresholds and ceilings provided for by law.

Subject to the publication of the final results on 8th April 2022, the new gross amounts (in euros) should be as follows:

The amount for the tax exemption limit for the settlement agreement indemnity, the voluntary indemnity in case of resignation or termination by mutual agreement, being calculated on 1st January of the concerned year, is still EUR 27,084.40. It will be equal to EUR 27,760.56 from 1st January 2023.

2. Tripartite agreement of 31st March 2022

The Government, the UEL and the LCGB and CGFP unions reached an agreement on 31st March 2022 to take measures in favor of businesses, purchasing power and for housing[2].

It was especially decided to:

- postpone to April 2023 the increment that should have fallen in August 2022;

- postpone by 12 months any potential additional increment in 2023.

There will therefore be no new indexation of salaries until April 2023.

In return, measures in favour of purchasing power will be taken, such as the energy tax credit for salaries and pensions below EUR 100,000 per year.

This agreement is valid until 31st March 2023. If the economic and social situation worsens in 2023, or if an additional index bracket is triggered in 2023, a new meeting of the Tripartite Coordination Committee will be convened.

3. Circular CSSF 21/769

In its 31st March 2022 release[3], the CSSF announced the implementation of Circular 21/769 of 9th April 2021 on teleworking in supervised entities as of 1st July 2022.

As a reminder, this Circular defines the governance and security requirements for supervised entities that must be respected when teleworking. In particular, a telework policy must be put in place, do not hesitate to consult us if you have not yet drafted it! D-3 months!