3.2% increase in the social minimum wage

Bill no 8117 [1] intends to increase the minimum social wage by 3.2% on 1st January 2023:

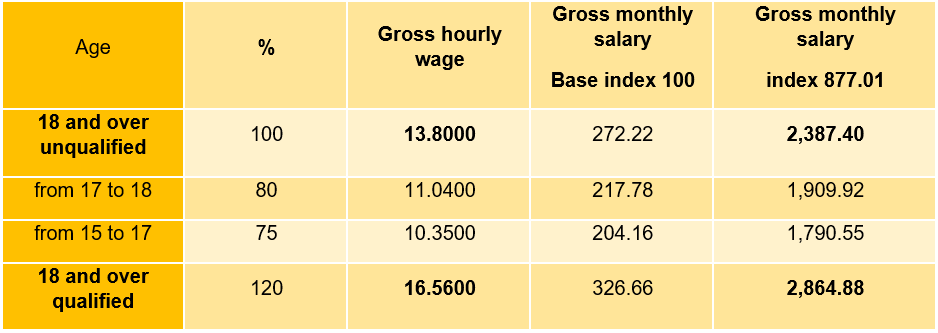

unqualified minimum social wage would increase from EUR 263.78 to EUR 272.22 gross at index 100; and,

- qualified minimum social wage would increase from EUR 316.54 to EUR 326.66 gross at index 100.

Thus, on 1st January 2023, the new gross amounts (in euros) would be as follows:

The increase in the social minimum wage will have an impact on the amount of the threshold for the tax exemption for the settlement agreement indemnity, the voluntary indemnity in case of resignation or termination by mutual agreement. This amount would increase on 1st January 2023 to EUR 28,648.80 gross.

[1] Bill no. 8117 amending Article L. 222-9 of the Labour Code (submitted on 12th December 2022).